"QDRO Calculation Services"

DETAILS ON HOW TO PROCEED IF INTERESTED

NOTE: NO LONGER TAKING ORDERS. USE ONLY FOR INFORMATION!!

The calculations we use follow the industry standard method and with the help of the tables and explanations we provide to you they are easy to understand and explain. They work for cases where there is a premarital contribution or in cases where there is none. You will have to obtain the account information that the account provider will give you. Specifically you will need to know the account value at the date of the marriage, at the complaint date, at the calculation date as well as how much funds were added at intervals (using quarterly, semi-annual or yearly) to the account and the account value at the beginning and end of each of these periods. If you work for a large corporation they can provide you this data. Sometimes there are delays between the calculation date and disbursement date and additional funds are added to the account and the total account value will change. Sometimes your company may adjust the marital value from the value you supply them at the calculation date to the updated value on the day they disburse the funds into the two accounts (or we can do that also at no additional charge if you give us the exact disbursement date and any additional contributions between the calculation date and disbursement date and the total value of the account at the disbursement date). It is just an updated calculation date.

To use our service you will need either quarterly, semiannual or annual summaries of the additions and value of the account. Quarterly statements provide a more accurate estimation but sometimes the account holders will only provide annual statements. We have an algorithm that helps give fair values even when the time periods are longer. The forms you will need to fill out are available on our site in the download forms tab. There is a description on how to use them on that page. Note that there is NO charge to simply download the forms- you can do it at anytime. The final calculations are reported to you in an easy to print format which can be shared as a PDF file to send to anyone else involved in the case. We hope that will save you time, money and aggravation by allowing you and the other party to get through a difficult divorce process.

We can also include at a nominal charge if you so desire a calculation of the value of a pension account that may also be subject to QDRO division. This is easier to calculate as the marital value is simply the value of the pension multiplied by the fraction of time during the work years that the parties were married. We present this in an understandable report as well. Note that our report allows you to calculate the QDRO division, but WE DO NOT DRAFT THE QDRO AGREEMENT. Your lawyer will usually do that or there are online resources to help with that if you wish. We can always provide you for no additional fee a new total if the final calculation date changes from the date we have used earlier to calculate the split.

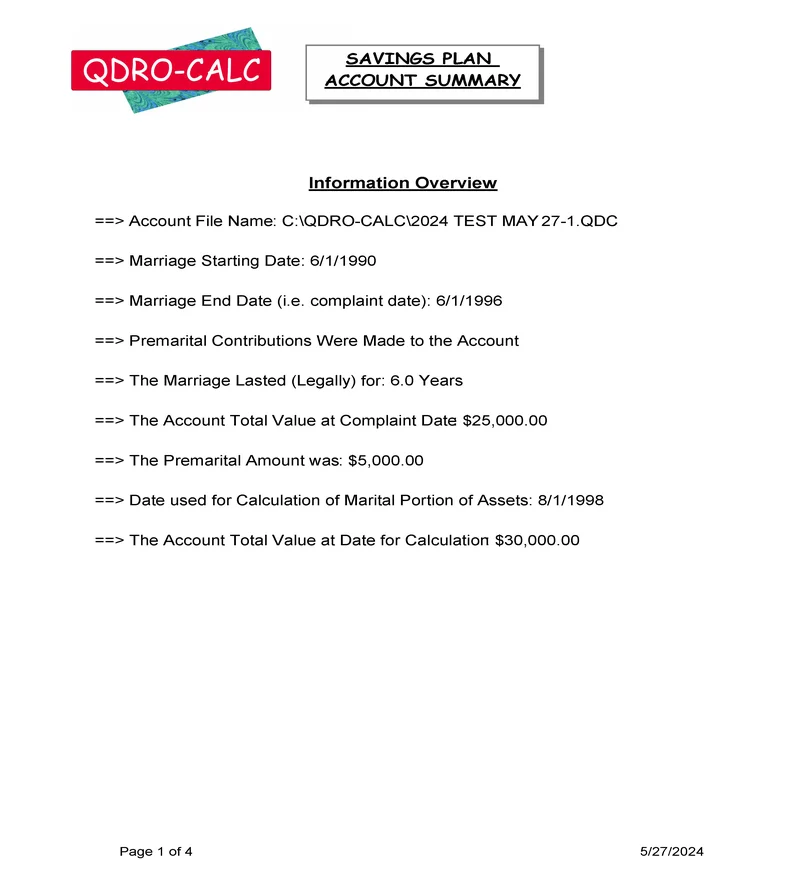

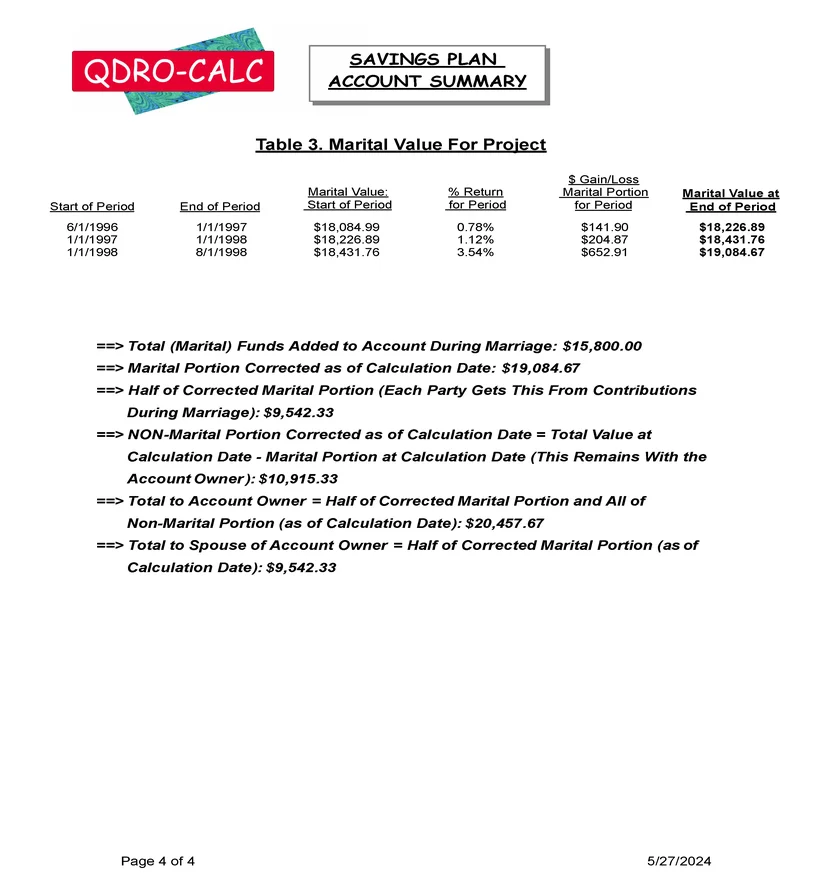

In the following tables we show a screenshot of the first and last of the 4 pages of a report. This was a case where the values of the account were obtained every 12 months. In the first page a summary of the relevant input information is shown. Pages 2 and 3 (not shown here) contain tables and explanations on how the calculation proceeds. It shows the amounts of marital funds added during marriage, how the marital portion and how the non-marital portion are corrected to the current date based on changes in the account value. Page 4, shown below, is just a summary of the calculations on pages 2 and 3 and shows how much the account owner and spouse each will receive from the account. If you have any difficulties in understanding our calculation for you, we will be happy to explain it to you.